Accelerate Your Cash Flow with Invoice Financing. Unlock the Power of Quick Funding Corp to Optimize Your Business Operations and Fuel Growth. Get Funded Today!

WHAT IS

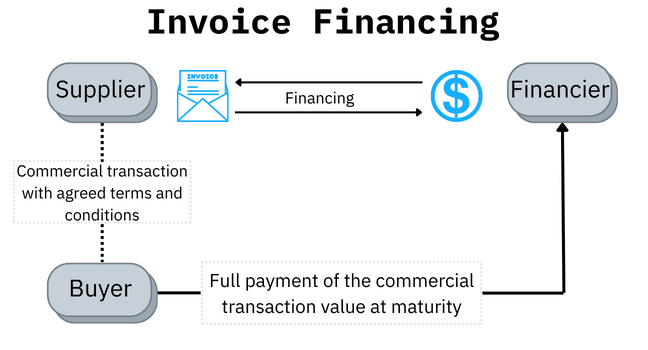

Invoice Financing is a hassle-free process where you submit your outstanding invoices to Quick Funding Corp. In return, we provide you with upfront funds, typically a percentage of the invoice value. No more delays in accessing the capital you need to invest in growth opportunities or tackle urgent financial commitments.

Quick Funding Corp takes care of the collection process, ensuring your clients make timely payments. Once your invoices are paid, we release the remaining funds to you, deducting a small fee for our efficient and reliable services. Experience an alternative funding option that eliminates the wait, and empowers your business to thrive.

Our innovative financing solution offers businesses the opportunity to unlock the value of their outstanding invoices, providing immediate access to funds and boosting cash flow. Say goodbye to waiting for clients to pay and hello to a world of financial flexibility and growth opportunities. Experience the freedom to invest in your business’s future with Quick Funding’s Corp efficient and reliable invoice financing solution.

Invoice financing accelerates cash flow by providing immediate funds based on the value of your outstanding invoices. Say goodbye to lengthy payment delays and seize growth opportunities as they arise.

With quick access to funds, you can seize investment opportunities, expand your business, or meet unexpected expenses without the constraints of waiting for invoice payments.

Our seamless invoice financing process eliminates the need for complex loan applications. Simply submit your outstanding invoices, and we'll take care of the rest, allowing you to focus on your business.

Quick Funding handles the collection process, reducing the risk of bad debts. We ensure timely payments from your clients, providing peace of mind and financial stability.

Unlike traditional loans, invoice financing doesn't require collateral. Your invoices act as collateral, making it an attractive alternative funding solution for businesses.

With steady cash flow, you can invest in new equipment, hire talented staff, expand your operations, or explore new markets, driving your business towards long-term success.

Invoice financing is a powerful financing tool that empowers businesses like yours to access the value of outstanding invoices swiftly. At Quick Funding Corp, we understand the importance of maintaining a healthy cash flow and the impact it has on your ability to grow and invest in your business.

Our streamlined process makes acquiring invoice financing hassle-free. Simply submit your outstanding invoices to QuickFunding crop, and we’ll provide you with a percentage of their value upfront. No more waiting for clients to pay. We take care of the collection process, ensuring timely payments from your clients.

As a trusted partner in your business’s success, Quick Funding Corp offers flexible financing solutions tailored to meet your specific needs. Our expert mortgage advisors are here to guide you through the process, providing personalized assistance every step of the way. With our extensive network and industry expertise, we can help you unlock the funds you need to fuel your business’s growth and seize new investment opportunities.

Experience the power of invoice financing with Quick Funding Corp and take your business to new heights. Let us be your reliable financial partner, providing innovative funding solutions to support your success.

2810509 Ontario Corp. O\A Canadian Capital Financial Services (CCFS), Lic#13367; Chief Executive Officer: John (Adam) Watson, Lic# M21001051; Principal

Broker: Peter F. Holgate, Lic# M08001212; Mortgage Originator: Rick Gandhi, Lic# M220000716; Each office is independently owned and operated.

Address: 10 Kingsbridge Garden Circle, Ste. 803 Mississauga, ON L5R 3K7