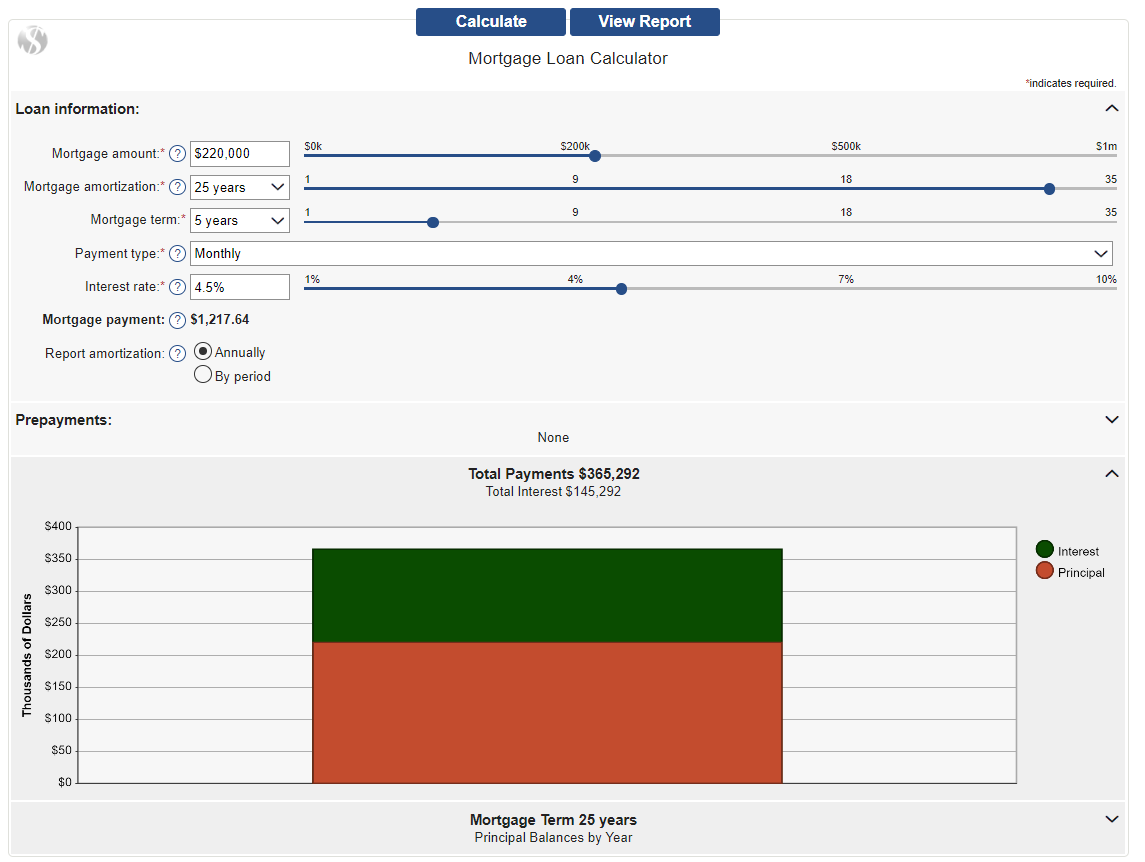

Use this calculator to generate an amortization schedule for your current mortgage. Quickly see how much interest you will pay, and your principal balances. You can even determine the impact of any principal prepayments! Press the report button for a full amortization schedule, either by year or by month.

Original or expected balance for your mortgage.

Annual interest rate for this mortgage.

The number of years over which you will repay this loan. The most common mortgage amortization periods are 20 years and 25 years.

Your principal and interest payment (PI) per period.

The payment type determines the frequency of payments. Monthly will have 12 payments per year, weekly 52, bi-weekly 26 and bi-monthly 24.

Accelerated weekly and accelerated bi-weekly payment options are calculated by taking a monthly payment schedule and assuming only four weeks in a month. We calculate an accelerated weekly payment, for example, by taking your normal monthly payment and dividing it by four. Since you pay 52 weekly payments, by the end of a year you have paid the equivalent of one extra monthly payment. This additional amount accelerates your loan payoff by going directly against your loan’s principal. The effect can save you thousands in interest and take years off of your mortgage.

The accelerated bi-weekly payment is calculated by dividing your monthly payment by two. You then make 26 bi-weekly payments. Just like the accelerated weekly payments you are in effect paying an additional monthly payment per year.

Total of all monthly payments over the full term of the mortgage. This total payment amount assumes that there are no prepayments of principal.

Total of all interest paid over the full term of the mortgage. This total interest amount assumes that there are no prepayments of principal.

The frequency of prepayment. The options are none, weekly, bi-weekly, semi-monthly, monthly, yearly and one-time payment.

Amount that will be prepaid on your mortgage. This amount will be applied to the mortgage principal balance, based on the prepayment type.

This is the payment number that your prepayments will begin with. For a one-time payment, this is the payment number that the single prepayment will be included in. All prepayments of principal are assumed to be received by your lender in time to be included in the following month’s interest calculation. If you choose to prepay with a one-time payment for payment number zero, the prepayment is assumed to happen before the first payment of the loan.

Total amount of interest you will save by prepaying your mortgage.

Choose how the report will display your payment schedule. Annually will summarize payments and balances by year. Monthly will show every payment for the entire term.

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

2810509 Ontario Corp. O\A Canadian Capital Financial Services (CCFS), Lic#13367; Chief Executive Officer: John (Adam) Watson, Lic# M21001051; Principal

Broker: Peter F. Holgate, Lic# M08001212; Mortgage Originator: Rick Gandhi, Lic# M220000716; Each office is independently owned and operated.

Address: 10 Kingsbridge Garden Circle, Ste. 803 Mississauga, ON L5R 3K7